Article

Underinsurance Case Study In Strata

October 09, 2025

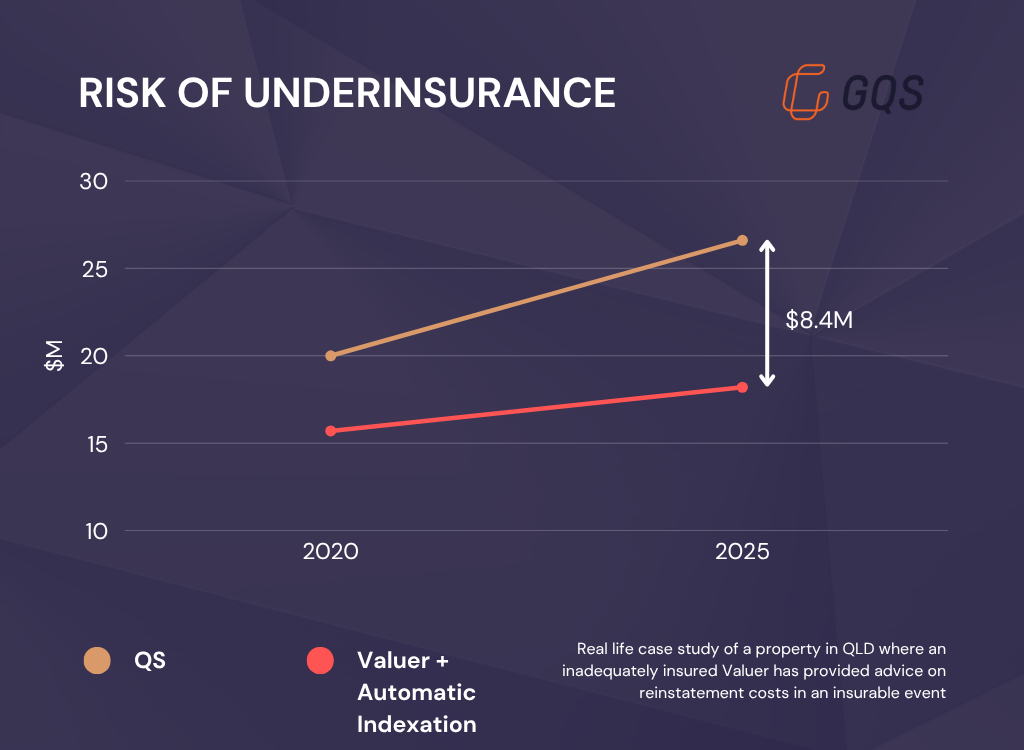

How a 2020 reinstatement cost estimate for insurance left one strata property $8.4M underinsured in 2025.

When COVID hit, few anticipated the surge in construction costs. Yet thousands of properties remain insured based on outdated pre-pandemic figures — leaving owners in strata dangerously exposed. If that pre-pandemic figure was also too low, it exacerbates the problem even further.

Here’s a real example that has come through our office this week:

2020 Estimate: $15.7M (prepared by a property valuer)

2025 Indexed Value: $18.2M (after insurer indexation)

2025 QS Estimate: $26.6M

That’s an $8.4M shortfall and there is a few main elements at play here as to why.

Starting from an undervalued base and relying on automatic indexation from the Insurer can create a false sense of security that leads to serious financial risk.

From what we have seen over the past 5 years, in most instances insurer’s automatic indexation hasn’t been enough to cover the increase in construction costs.

Insurers typically (check your policy for clauses such as ‘averaging’ and ‘co-insurance’) pay proportionally when you’re underinsured. This means in this example that a partial repair bill of say $1M, only ~$684k will be covered by the Insurer and the Owner’s have to foot the bill for the remainder.

If the Owners have to raise significant funds to make up for the shortfall this can also cause significant delays in actually getting the work completed post insurable event (delays = more $).

The original estimate in this scenario was completed by a Registered Property Valuer. They actually disclaimed in their report that they weren’t a QS and that the Body Corporate should seek the advice of a QS. This isn’t unusual, our biggest referrers are Valuers (we work very closely with many Valuers and I’m not having a crack here) who know they are limited when it comes to advising on construction costs. This is also a standard disclaimer in a Valuer’s mortgage valuation where the banks force a Valuer to provide an opinion on replacement cost.

I know I’m a QS and of course this is my opinion, but in all honesty as a lot owner in a body corporate myself, my recommendation is as follows:

1. Engage a Certified QS for an accurate replacement cost estimate for insurance purposes. This figure is not the same as the original construction contract sum.

2. Review your building sum insured every 2–3 years (or more frequently). The legislative 5 year period is too long at the moment.

3. Don’t assume annual insurer indexation keeps pace with actual construction cost escalation. In the past it was too much, over the past 5 years it hasn’t been enough.

4. Make sure unless there is a reason why, that an inspection is undertaken to ensure adequate coverage of the property as a whole and all the components within.