Article

Incorporate Property Depreciation Into Your Cashflow Projections

July 07, 2021

Property depreciation is one of the biggest tax deductions available to an investor and yet it is so often under utilised. It has significant contributions to cash available at the end of the year, and can be the difference between a cashflow-positive and a cashflow-negative investment.

Properlytics is a simple-to-use software that helps current and aspiring investors understand the true value of their investments. Manipulate key property details to illustrate how an increase in weekly rent, a jump in body corporate fees or added tax deductions can affect your cashflow over the next few years. Investors may adapt it for their ‘what-if’ analysis so they can mitigate risk while still leveraging their money to its full potential.

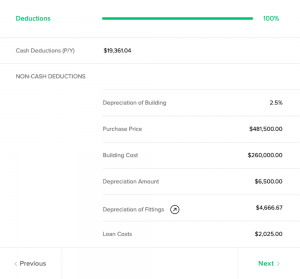

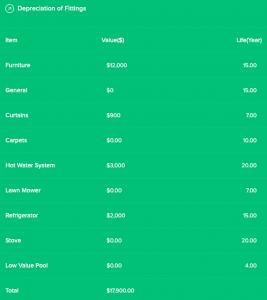

The platform allows you manually update your building costs, depreciation amount and loan costs while also diving deeper into the depreciation of fittings. To calculate your depreciation of fittings, simply open out table and start entering all the details.

As you can see above, you are able to update the value of all the fittings and select either diminishing value or prime cost depending on how you are calculating your depreciation.

Once you have entered all the details into the table, click save and all the values will appear in your Properlytics report.

To find out more information about Properlytics, please visit their website here.

Properlytics will simplify how you calculate your deductions for your property in an easy to understand format, making what can be an extremely difficult and confusing process much easier!